Manual Payroll Calculations

How to do Payroll Taxes and Process Payroll Yourself After you hire your first employees and review, you need to figure out how to get them paid. There are three ways to approach payroll processing — do payroll yourself, use a payroll service like, or hire an accountant. Below, we walk you step by step through what each way entails, as well as which option might be best for your business. Remember, this post is for educational purposes only. For specific advice, be sure to consult with a professional.

How to do Payroll Taxes are federal, state and local taxes withheld from an employee’s paycheck by the employer. They include Income Tax, Social Security, and Medicare. In order to properly calculate what your payroll tax should be, you need to know the current tax rates.

For example, the Social Security tax for 2016 is 6.2% and the Medicare tax rate is 1.45%. The percentages are determined on a yearly basis. If you want to know how to process payroll yourself, read below. Get Started with Square Payroll Payroll processing trusted by thousands. How to Process Payroll Yourself Summary: Low cost but time consuming and prone to errors. If you’re tax savvy, you may be able to take on a DIY approach to paying your employees.

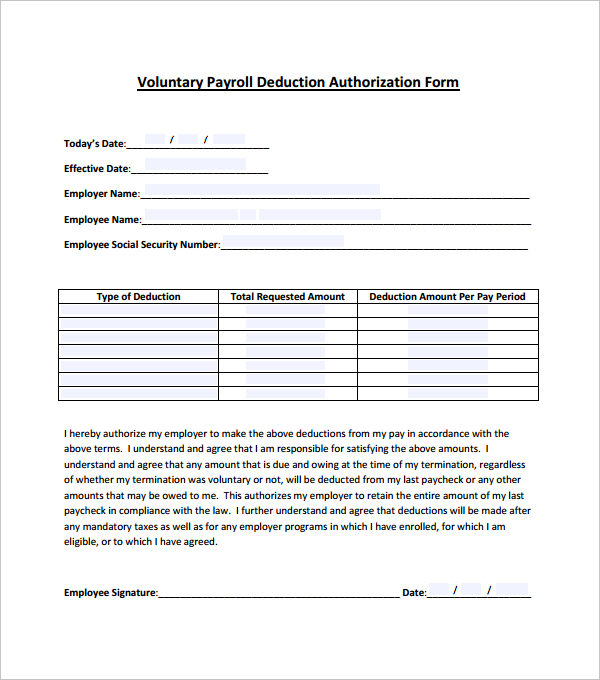

But given (and nasty fines you can incur as a result), make sure you’re completely comfortable with everything you need to do before you dive in. To get started: Step 1: Have all employees complete a W-4. To get paid, employees need to complete to document their filing status and keep track of personal allowances.

Mercedes ml w163 manual. We do it ourselves to help you do-it-yourself, and whatever your mechanical ability, the practical step-by-step explanations, linked to over 900 photos, will help you get the job done right.

The more allowances or dependents workers have, the less payroll taxes are taken out of their paychecks each pay period. Note that for each new employee you hire, you need to file a new hire report. Step 2: Find or sign up for Employer Identification Numbers. Before you do payroll yourself, make sure you have your Employer Identification Number (EIN) ready. An EIN is kind of like an SSN for your business and is used by the IRS to identify a business entity and anyone else who pays employees. If you don’t have an EIN, you can on the IRS site. You may also need to get a state EIN number; check your state’s employer resources for more details.

Manual Payroll Calculations Setting

Step 3: Choose your payroll schedule. After you, (don’t forget workers’ compensation), and display workplace posters, you need to add three important dates to your calendar: employee pay dates, tax payment due dates, and tax filing deadlines (read more about ). Step 4: Calculate and withhold income taxes. When it comes time to pay your employees, you need to determine which federal and state taxes to withhold from your employees’ pay by using the and your state’s resource or a reliable paycheck calculator. You must also keep track of both the employee and employer portion of taxes as you go. Step 5: Pay taxes.

When it’s time to pay taxes, you need to submit your federal, state, and local tax deposits, as applicable (usually on a basis). Step 6: File tax forms & employee W-2s. Finally, be sure to send in your employer federal tax return (usually each quarter) and any state or local returns, as applicable. And last but not least, don’t forget about preparing your annual filings and at the end of the year. Note: This is not an exhaustive list of your responsibilities as an employer. For advice specific to your business, be sure to go over federal and state requirements or consult with a professional. Alternative 1: Use a payroll service Summary: Low-to-medium cost and reliable Don’t worry if the DIY method is not for you, payroll services make it easier for small business owners to pay their employees and get back to their core business functions.

Most payroll services calculate employee pay and taxes automatically and send your payroll taxes and filings to the IRS and your state’s tax department(s) for you. With a full-service provider like Square Payroll, you can even keep track of hours worked, import them directly to your payroll, and pay employees by direct deposit. Here’s how it works: How to process payroll with a payroll service: Just like with the DIY option above, you need to have all your employees complete a Form W-4 and find or register for Employer Identification Numbers.

Manual Payroll Calculations

From there: Step 1: Choose a full-service payroll provider. If you’re not sure how to do payroll yourself, use that reduces the risk of errors or fines. Many payroll processing services, like, handle your, filings, new hire reporting for you, and allow you to complete payroll online.

Sign up takes minutes — so you can quickly start doing your own payroll the same day you sign up. Step 2: Add your employees.

You need to set up your employees before you process their payroll. Adding employees you’re paying for the first time is generally quicker; if you’re switching to a new payroll provider, then you also need to add your current employees’ year-to-date payroll information. Either way, you generally need to enter employee names, addresses, Social Security numbers, and tax withholding information. If you’re using Square Payroll and would like to pay employees using direct deposit, you can just enter your employees’ names and email addresses so they can enter their personal information themselves. Step 3: Track hours worked and import them.

Department of Labor requires employers to keep track of. Certain states may have longer retention requirements; be sure to check the specific requirements in your state. You can track time using your Square Point of Sale and to payroll. Step 4: Process your first payroll run.

Click Send and you’re done! Step 5: Keep track of your tax payments and filings. The IRS requires tax forms to be kept for.

Certain states may have longer retention requirements; be sure to check the specific requirements in your state. With Square Payroll, you can find copies of your tax filings in your dashboard.

Alternative 2: Hire an accountant Summary: Most expensive option but reliable If you don’t want to learn how to do payroll yourself or use a payroll service, consider hiring an accountant. A good accountant can process your payroll and make sure your tax payments and filings are taken care of. Check out these. Published March 25, 2016 Related Articles You May Also Like.