Baker Solution Manual

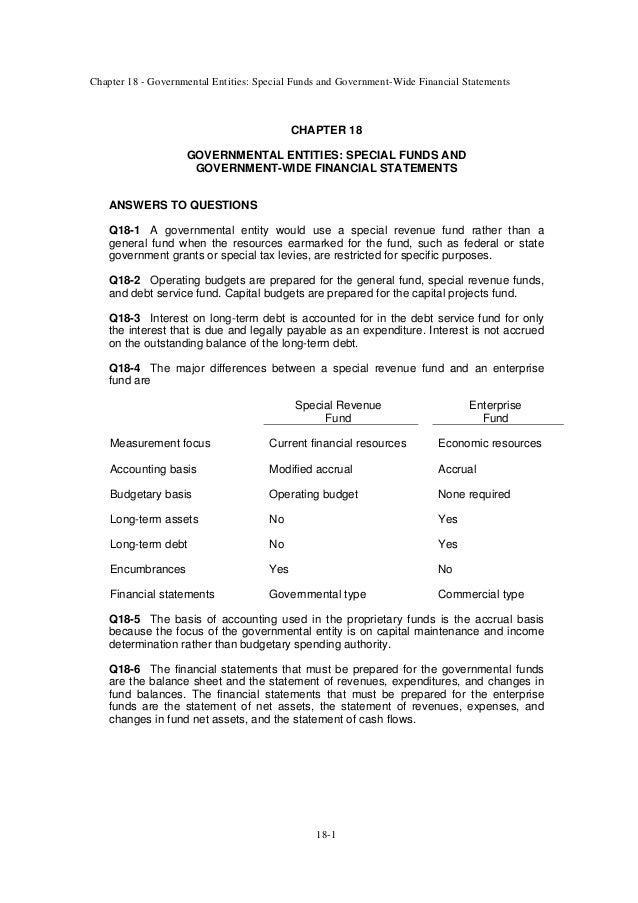

Solution Manual Advanced Financial Accounting by Baker 9th Edition Chapter 16. 1. Chapter 17 - Governmental Entities: Introduction and General Fund Accounting 17-1 CHAPTER 17 GOVERNMENTAL ENTITIES: INTRODUCTION AND GENERAL FUND ACCOUNTING ANSWERS TO QUESTIONS Q17-1 A fund is an independent fiscal and accounting entity with a self-balancing set of accounts recording cash and/or other resources together with all related liabilities, obligations, reserves, and equities which are segregated for the purpose of carrying on specific activities or attaining certain objectives in accordance with special regulations, restrictions, or limitations. A fund may receive resources from a variety of sources, including collection of taxes on property, income, or commercial sales; receipt of grants, fines, or licenses; and collection of service charges. Q17-2 The eleven funds generally used by local and state governments are: Governmental a. General fund b. Special revenue fund c.

Solution Manual Baker

Capital projects fund d. Debt service fund e. Permanent fund Proprietary f.

Internal service fund g. Enterprise fund Fiduciary h. Pension trust fund i. Investment trust fund j. Private-purpose trust fund k. Agency funds The purpose of each fund is individually discussed below: a.

General fund: All financial resources except those required to be accounted for in another fund are accounted for in the general fund. Special revenue fund: The proceeds of specific revenue sources that are legally restricted for specified purposes are accounted for in the special revenue fund. Capital projects fund: Financial resources to be used for the acquisition or construction of major capital projects that will benefit a large population are accounted for in the capital projects fund.

Chapter 17 - Governmental Entities: Introduction and General Fund Accounting 17-2 Q17-2 (continued) d. Debt service fund: The accumulation of resources for and the payment of, general long-term debt principal and interest are accounted for in the debt service fund. Permanent fund: Accounts for resources for which the principal must be maintained, but for which the earnings may be used in support of governmental programs. Internal service fund: The financing of goods or services provided by one department or agency to other departments or agencies of the governmental unit, or to other governmental units, are accounted for in internal service funds. Enterprise fund: Operations of governmental units that charge for services provided to the general public are accounted for in the enterprise funds.

Pension trust fund: Resources held by a governmental unit in a trustee capacity for the members and beneficiaries of pension plans, postemployment plans, or other employee benefit plans. Investment trust funds: Accounts for the external portion of investment pools of governing units. Private-purpose trust fund: Accounts for trust arrangements under which both principal and interest may be used to benefit specific individuals, private organizations, or other governmental units. Note that these resources have specific purposes as stated by the donor or grantor, and are not available for general governmental programs. Agency funds: Assets held by a governmental unit in an agency capacity for employees or other individuals are accounted for in agency funds.

Q17-3 The modified accrual basis includes some aspects of accrual accounting and some aspects of cash-basis accounting. Under the modified accrual basis, the emphasis is on reporting how well the government performed by focusing on when the revenue and expenditures are recognized in the accounts and reported in the financial statements. The emphasis is not on how much was earned or on the amount of expenses.

Q17-4 The modified accrual basis is used for funds for which expendability is the concern because the governing entity is interested in the determination of the resources still remaining to be expended to carry out the objectives of the fund. Q17-5 Property taxes are recognized as revenue in the general fund when the taxes are levied, provided they apply to and are collectible within the current fiscal period, or within a short period (.

Mercedes • Select Make. 2009 • Select Year. 2009 mercedes c300 battery.

Why is Chegg Study better than downloaded Advanced Financial Accounting PDF solution manuals? It's easier to figure out tough problems faster using Chegg Study.

Unlike static PDF Advanced Financial Accounting solution manuals or printed answer keys, our experts show you how to solve each problem step-by-step. No need to wait for office hours or assignments to be graded to find out where you took a wrong turn.

You can check your reasoning as you tackle a problem using our interactive solutions viewer. Plus, we regularly update and improve textbook solutions based on student ratings and feedback, so you can be sure you're getting the latest information available. How is Chegg Study better than a printed Advanced Financial Accounting student solution manual from the bookstore? Our interactive player makes it easy to find solutions to Advanced Financial Accounting problems you're working on - just go to the chapter for your book.

Hit a particularly tricky question? Bookmark it to easily review again before an exam. The best part? As a Chegg Study subscriber, you can view available interactive solutions manuals for each of your classes for one low monthly price. Why buy extra books when you can get all the homework help you need in one place?